In Praise of Efficient Price Gouging - MIT Technology <b>Review</b> |

- In Praise of Efficient Price Gouging - MIT Technology <b>Review</b>

- New <b>Car Review</b> | Questions and Observations

- <b>Car Review</b>: 2015 Hyundai Sonata | BlackPressUSA

| In Praise of Efficient Price Gouging - MIT Technology <b>Review</b> Posted: 18 Aug 2014 09:05 PM PDT Uber's most important innovation is the way it prices its services. But that innovation has not been unreservedly welcomed by customers. They're wrong.

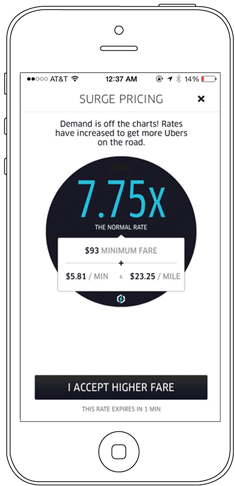

In the four years since the car service Uber launched, it has been beset by criticism from myriad groups, including city officials annoyed by its sometimes cavalier attitude toward regulation and taxi companies annoyed by increased competition. Some of the harshest criticism, though, has come from an unlikely place: Uber's own customers. Thanks to its reliance on what it calls "surge pricing"— meaning that during times of high demand, Uber raises its prices, often sharply—the company has been accused of profiteering and exploiting its customers. When Uber jacked up prices during a snowstorm in New York last December, for instance, there was an eruption of complaints, the general mood being summed up by a tweet calling Uber "price-gouging assholes." What's striking about the Uber backlash is that the company is hardly the first to use dynamic pricing. There have always been crude forms of price differentiation—or, as it is known in economics, price discrimination. If you go to a movie matinee, you pay less than if you go at night, and if you're willing to wait to buy a new dress (and run the risk that it might sell out), you can often get it at a marked-down price. But dynamic pricing in a more rigorous sense was pioneered in the 1980s by Robert Crandall, CEO of American Airlines, as a way to fight off competition from discount airlines like People Express. American began by slashing prices for tickets bought well in advance, while keeping prices for tickets bought closer to takeoff (when ticket inventory was lower, and demand was less price-sensitive) as high as possible. In the decades since, this kind of yield management has become integral to the business models of airlines, hotels, and rental-car companies, and greater computing power and more sophisticated data analysis has turned pricing in these industries into an incredibly complex process. (Dynamic pricing has also allowed sites like Priceline and Hotwire to flourish, since when hotels are stuck with extra rooms, they're often willing to drop prices rather than let a room sit empty.) More recently, as technology has made it easier to segment the market and change prices on the fly, dynamic pricing has become common in other industries, too. Many professional sports teams now use it to set ticket prices—games against high-profile teams cost more than games against cellar dwellers—while concert ticket prices wax and wane with demand. If dynamic pricing is hardly unusual, why has Uber taken so much flak? Some of it is a matter of history: early on, Uber's pricing was not especially transparent, so customers occasionally found themselves stuck with fares that were much higher than they expected. The fact that some of the most high-profile examples of surge pricing have been the result of big storms also matters, since it taps into people's visceral dislike of price gouging. A 1986 study by Daniel Kahneman, Jack Knetsch, and Richard Thaler found that most people thought "raising prices in response to a shortage is unfair even when close substitutes are readily available"—a situation that almost perfectly describes Uber. Then, too, the price increases during surges are often magnitudes greater than customers are used to; during that New York snowstorm, Uber charged up to nearly eight times as much as it usually did. Thaler has suggested that people find price increases above three times normal psychologically intolerable.

It's also important that Uber's prices only rise above the base rate and never fall below it, since customers seem to accept dynamic pricing more easily when it's characterized as a discount. At the movies, for instance, prime-time tickets aren't presented as a few dollars more than the normal price—rather, matinees are presented as a few dollars less. When American introduced dynamic pricing, it framed the 21-day advance-purchase requirement as a chance to buy "super-saver" fares. And happy hours at bars are, similarly, framed as a markdown from the regular price. These framing devices don't change the underlying economics or price structure, but they can have a big impact on customer reaction. In 1999, for instance, Douglas Ivester, then the CEO of Coca-Cola, suggested that smart vending machines would allow Cokes to be more expensive on hot days, when demand was presumably higher. There was an immediate, intense backlash, and the company quickly backed down, saying Ivester's comments were purely hypothetical. Had Ivester instead suggested that Coca-Cola could use dynamic pricing to charge less on cold days (even if it had raised the base price of a can), response would probably have been very different. Uber's competitor Lyft seems to have recognized the power of framing: it recently introduced what it calls happy-hour pricing, offering discounts during slow business hours. Finally, Uber also faces a challenge simply because of the industry it's in: a business in which fares have historically been regulated (for cabs) and fixed (if you take a car service to the airport in New York, for instance, you typically pay the same price whether you leave at 6 a.m. or 5 p.m.). Uber's pricing scheme is more complicated and harder to grasp intuitively, so that even though Uber is transparent about surge pricing, some people inevitably find it vexing. Uber's also combating the sense that transportation is, in some sense, a public utility, and that it's offensive to charge people so much more than they're used to paying. This is a mysterious complaint, since there are many alternatives to using Uber. But it's a surprisingly common one. It's easy to see, then, why Uber has become a flash point for criticism. But there is a deep irony here: the company arguably offers the most economically sensible, and useful, example of dynamic pricing in today's economy. In most cases, after all, dynamic pricing is a way for companies to maximize profits by exploiting demand—charging higher prices to people who can and will pay more. As MIT professor Yossi Sheffi has put it, it's the "science of squeezing every possible dollar from customers." That's because most industries that use dynamic pricing have a limited inventory (an airline flight has a set number of seats, a hotel a set number of rooms) and are trying to make as much money from selling that inventory as possible. Uber's case is different. While the company also wants to make as much money as possible, it uses surge pricing not only to exploit demand but to increase supply.  The Uber app tells users how much the rate has increased during times of high demand. When there are more would-be Uber passengers than available Uber cars, the company's algorithm sets a price that balances supply and demand. Uber's algorithm (which it has been refining since 2011) is the company's greatest asset and most significant innovation, allowing it to find the price that will attract drivers—whom, as independent contractors, it can't order onto the road—without alienating customers. The strategy works. In a recent blog post, the venture capitalist Bill Gurley, who's an Uber board member, said that when Uber first tested dynamic pricing in Boston in 2012, it was able to "increase on-the-road supply of drivers by 70 to 80 percent." Plenty of us have an intuition that cab drivers would want to be on the road when there's money to be made. But this isn't the case: a number of studies have shown that there's considerable variety in how they decide when to drive. Also, the reality is that the times when people most want a ride are also the times when it's most annoying and, often, most risky to drive. Rush hour, New Year's Eve, 2 a.m. on a Saturday night, snowstorms: generally speaking, these are exactly the times when a driver doesn't want to be on the road. But if driving at those times pays considerably better, then they are more likely to be willing. What this means is that in the case of Uber, surge pricing doesn't just make rides more expensive (as is the case with airline tickets or hotel rooms at times of high demand). It also expands the number of people who are actually able to get a ride. Customers pay more, but they also get a ride that they otherwise would not have gotten. This is exactly how a market is supposed to work: higher demand induces more supply. Of course, Uber has been making this argument for a while now, and it hasn't stopped people from complaining. (Though it hasn't stopped people from using the service, either: Uber is now valued at more than $17 billion.) So pundits have proffered a number of suggestions for solving the public relations problem. The company itself should take no money during surge periods (it now takes 20 percent of every fare), so all the money goes to the drivers. Or it should cap prices to consumers but pay the higher price to drivers, essentially subsidizing people's rides in surge periods. Or when prices rise really sharply, Uber should donate its take to charity. These are all interesting ideas. But it'd be a mistake for Uber to let public relations trump economics when it comes to dynamic pricing. It makes sense that the company recently reached an agreement with New York's attorney general that caps surge pricing during times of "emergency," since these emergencies are rare, and the negative fallout from them can be immense. But tinkering with the basic idea of surge pricing will only reinforce the status quo and bolster people's implicit assumption that prices should be set, in some sense, independently of supply and demand. The basic reality of Uber's business model is that when people want a ride the most, it's likely to be the most expensive. This will always be irritating, just as exorbitant prices for last-minute airline tickets are irritating. But over time, surge pricing will also become more familiar and less surprising. Utilities are now starting to use dynamic pricing for electric power, which can help prevent blackouts at times of high demand and promote energy conservation more generally. A new startup called Boomerang Commerce, which is led by former Amazon engineers, has been helping online retailers set prices dynamically. Dynamic pricing is the future, even if the road to get there will be bumpy. James Surowiecki writes "The Financial Page" for the New Yorker. |

| New <b>Car Review</b> | Questions and Observations Posted: 23 Aug 2014 10:01 PM PDT My newest car review is up. It's been a while, so I have a few backlogged. This is the first of them, a review about a popular transportation pod. |

| <b>Car Review</b>: 2015 Hyundai Sonata | BlackPressUSA Posted: 20 Aug 2014 08:19 AM PDT Car Review: 2015 Hyundai SonataAugust 20, 2014 Business AboutThatCar.com  By Frank S. Washington SUPERIOR TOWNSHIP, Mich. – The Sonata is Hyundai's second best-selling model and that is by a silvery thin 2 percentage points. So whenever the Korean automaker changes the car it is done with great care and great planning. For the 2015 model year, Hyundai wants to broaden the Sonata's customer base and bring it in line as the automaker moves to a more familial appearance for all of its vehicles. The new Sonata was a little bit longer, a little bit wider and a smidgen taller than the model it replaces. The styling was crisp, balanced and modern with taut surfaces. The grille mimicked that of the newly introduced Hyundai Genesis except its hexagonal form was not as deep. The rocker panels were taut and they seemed to help the car hug the ground. Its belt line was stretched to accentuate the Sonata's length. The Sonata Sport featured a more aggressive front grille and bumper, side rocker extensions and side chrome molding. The car looked low, long and fast. Inside, the Sonata's center stack had been replaced with a center control pod. The move follows the trend to more horizontal interior layouts. The pod was gently angled toward the driver and we thought the fit and finish was excellent. It almost looked like a two-dimensional image rather than three-dimensional control knobs and buttons. Hyundai wanted to make the controls intuitive and comfortable. That means the driver doesn't have to take his eye off the wrong for long periods to engage the controls. They pretty much accomplished that goal. Of course, there was a slight difference in the interior of the regular Sonata and the Sonata Sport. But that was mostly color and materials. The 2015 Hyundai Sonata, which went on sale in May, comes in nine different colors and it has six different interior schemes depending on the model. Consumers have three engine choices: a 2.4-liter four cylinder that makes 185 horsepower and 178 pound-feet of torque. Mated to a six-speed automatic transmission it gets 24 mpg in the city, 35 mpg on the highway and 29 mpg combined. A 2.0-liter turbocharged four cylinder makes 245 horsepower and an impressive 260 pound-feet of torque at 1,350 rpms. Mated to a six speed automatic gearbox, it gets 23 mpg in the city, 32 mpg on the highway and 26 mpg combined. The most impressive engine in the trio is the 1.6-liter four-cylinder turbo that makes 177 horsepower and 195 pound-feet of torque. Mated to a seven-speed dual clutch transmission, it gets 28 mpg in the city, 38 mpg on the highway and 32 mpg combined. This engine is only available in the Eco model. There are five other models: the SE, the Sport, the Limited, the Sport 2.0T and the Sport 2.0T w/ultimate package. Hyundai is covering a lot of ground in the midsize sedan segment with the variants of the Sonata. We drove the Sonata Sport 2.0T from here to Ann Arbor. In a nutshell, the front-wheel-drive sedan was spacious. Because of its four-cylinder engine, it had almost as much interior space in the front compartment as a full-size sedan. The car handled well and the suspension smoothed out the rutted roads. But the 2015 Hyundai Sonata could be tweaked just a little bit. The engine bay could use a little more soundproofing; we could hear that engine a little too much. There wasn't any torque steer but it could be called torque veer when the Sonata was under aggressive acceleration. And there was just the slightest bit of turbo lag. Still, all these characteristics had to be looked for, which is our job. It is doubtful that the average driver would even notice any of these gripes. There were three drive modes: normal, sport and Eco. The sport mode stiffened the suspension and quickened the steering. We listened to the sport talk radio but we really didn't listen to the audio system or use the navigation system. Our test vehicle was equipped with the ultimate package. It included a panoramic sun roof, lane departure and forward collision warning systems, rear parking aid, automatic high beams; a power passenger seat and ventilated (cooled) front seats. There was more in the package, including a navigation system, satellite radio and side sunshades in the rear. Our test vehicle was $34,460. Base prices range from $21,960 for the SE to $34,335 for the Sport 2.0T/Ultimate. Both prices include an $810 freight charge. Bottom line: the new Hyundai Sonata is a stylish, midsize sedan that can be equipped with all the bells and whistles and outfitted with an engine choice that meets the need of most everyday drivers. Frank S. Washington is editor of AboutThatCar.com

Like this Article? Share it!You must be logged in to post a comment. |

| You are subscribed to email updates from car review - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment